Table of Content

The more popular air-source heat pumps extract heat from outside and pump it into the house, much like an air conditioner in reverse. Some of the policies approved today in the Climate Action Council’s “final scoping plan’' require further action before they can be enforced. The new regulations on heating systems, for example, will require changes to the state building code. The plan adopted today by the state Climate Action Council requires energy-efficient electric heat pumps or other non-combustion heating systems in every new home built in 2025 or thereafter.

The administration is encouraging Americans to use the tests before traveling or visiting indoors with people with compromised immune systems. Homeowners canfind out what homeowner assistance covers, how it works, and who’s eligibleon the interagency housing portal hosted by the Consumer Financial Protection Bureau . If and when your application is approved, the funds are typically sent directly to your mortgage lender and other providers.

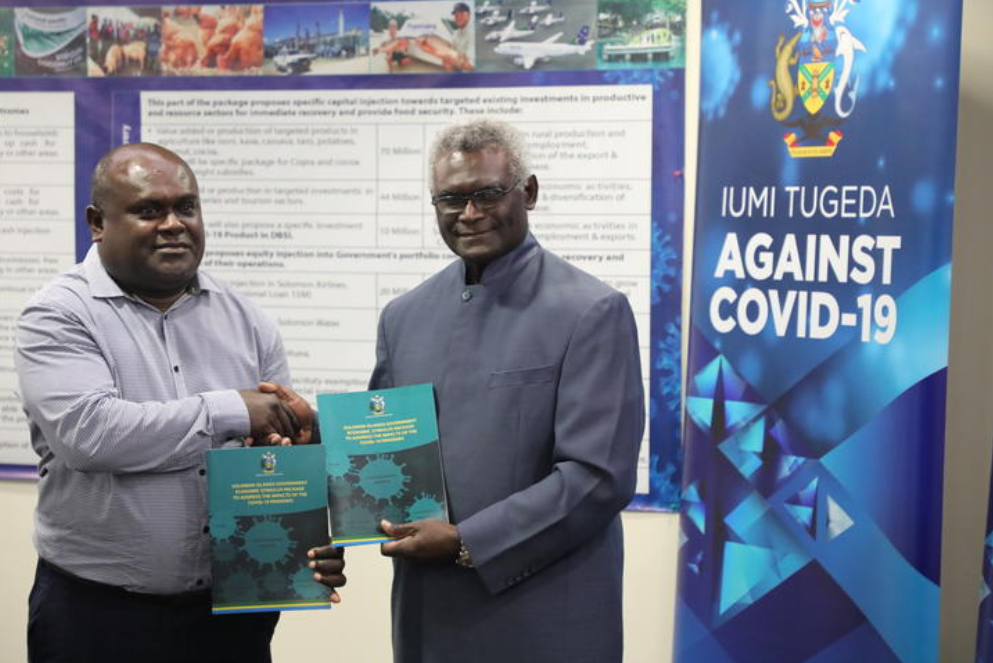

COVID19 Economic Relief

Importantly, your loan servicer cannot ask you to repay everything as a lump sum right after exiting forbearance. It’s more likely you’ll pay the missed amount in installments along with your regular mortgage payments or defer repayment until you sell the home or refinance. You can also use this lookup tool from the Consumer Financial Protection Bureau to find active mortgage relief programs in your area. HAF funds are allocated state by state, and it’s up to state administrators to distribute the funds to individual homeowners who qualify for aid.

If you own a home or are in the process of paying off your mortgage, you can access an additional $10 billion program set aside for homeowners who fell behind on bills during the pandemic. The Office of Recovery Programs is providing self-resources to assist recipients of awards from its programs with questions about reporting, technical issues, eligible uses of funds, or other items. This program is targeted to those people who are current in their mortgage, but can't refinance a bad interest rate because they have lost equity when the market dropped. Traditionally, you must have a 20% equity in your home in order to refinance, but under this program, you can owe up to 105% of your home's current market value.

When can people expect to receive new stimulus checks?

To qualify, you must own your home and have a mortgage with a balance of less than $550,000. You must also have an annual income that is lower than either your area’s median income or the national median income. Furthermore, 60% of the aid is earmarked for mortgages, and the funds from the program must be used before the end of September 2025. According to Biden’s team, 20% of renters are behind on payments, and more than 6 million homeowners failed to make mortgage payments in September of 2020. The moratorium blocks lenders from moving forward with foreclosure proceedings until June 30, 2021 at the earliest, offering struggling homeowners extra time to gather money together to make payments.

You only repay the loan when you sell your home or permanently leave it. Since funds will be distributed locally, tenants and landlords hoping to qualify for rent relief will need to check for programs operating in their area. Homeowners with government-backed loans simply have to ask their lender for forbearance and send in a letter stating they’re going through financial hardship as a result of the pandemic. Currently, mortgage companies cannot start foreclosure proceedings against homeowners who are unable to make home loan payments.

The American Rescue Plan

However, Fannie Mae and Freddie Mac (the ‘GSEs’) both have options to help homeowners who are struggling with their mortgage payments. To find out whether you qualify for mortgage assistance, reach out to your mortgage loan servicer. In February, President Biden directed federal housing regulators to extend mortgage forbearance programs for an additional six months and prolong other foreclosure relief programs. More than 3 million households are behind on their mortgage payments, and nearly 1.7 million will exit their forbearance period in September. However, loan modification is typically seen as a last resort for homeowners who can’t refinance or take advantage of other mortgage relief programs.

The IRS is still sending out the third round of stimulus checks, and many Democrats are pushing for more checks in the future. In his speech to the joint session of Congress last week, President Biden praised the impact of stimulus checks but did not comment on whether there would be more of them in the future. HOMEOWNERS can get more than $3,000-a-year in mortgage relief thanks to stimulus aid. Among the no votes on the council was Donna DeCarolis, president of Western New York gas utility National Fuel Gas. DeCarolis said the plan puts too much reliance on a single form of energy – electricity – when the existing natural gas networks could provide balance. Ground-source heat pumps, which represent about 20% of the market, use fluid circulating through underground lines to derive heat or cooling from the ground.

Assistance for State, Local, and Tribal Governments

The Treasury Department states that it uses local and national income indicators to maximize the impact of where the money is distributed. Recover direct payments from past stimulus payments you did not receive but qualified for when you file your 2020 taxes with the Internal Revenue Service’s Recovery Rebate Credit form. It insures mortgage loans from FHA-approved lenders against default. To apply for an FHA-insured loan, you will need to use an FHA-approved lender.Search for an FHA-approved lender here. The Federal Housing Administration manages theFHA loans program. This may be a good mortgage choice if you’re a first-time buyer because the requirements are not as strict as for other loans.

Any references to other sources or sites, is delivered “as is” and Sundae makes no representation or endorsement of any kind with respect to the accuracy of such information or its suitability for any particular use. Please seek the advice of an attorney, tax professional and/or financial advisor for guidance to properly evaluate particular investments and/or strategies. Extended unemployment benefit payments of $300 under the Pandemic Emergency Unemployment Compensation program through September.

The bill proposed to extend the residential eviction ban, which is currently set to March 31, but that didn’t pass. Homeowners are able to enroll in a mortgage forbearance program if they are unable to make monthly payments. Forbearance allows homeowners to postpone mortgage payments without getting late fees and other related consequences for not paying on time. This program addresses those homeowners who are facing foreclosure.

Even better, the VA’s “loan technicians” work with your lender on your behalf — so you don’t have to figure out all the logistics of a mortgage relief program yourself. Homeowners with federally-backed FHA, VA, and USDA mortgages have access to different mortgage programs than those with conventional loans. Homeowners who have experienced financial hardship during the pandemic have a few options for mortgage relief. If you’ve had a temporary job loss or reduction in income, it can be hard to keep up with mortgage payments — especially with an above-market mortgage rate that’s keeping your payments artificially high.

The initiative includes plans to increase access to vaccines, tests and treatment for both individuals and states, with a focus on protecting seniors. View information about how to connect with homeowner assistance near you. To qualify, incomes must be 150% or less of the area median income or 100% of the median income for the US, whichever is bigger.

Funds from the HAF may be used for assistance with mortgage payments, homeowner’s insurance, utility payments, and other specified purposes. The law prioritizes funds for homeowners who have experienced the greatest hardships, leveraging local and national income indicators to maximize the impact. In February, President Joe Biden directed federal housing regulators to extend forbearance for an additional six months and prolong other foreclosure relief programs past their December 31 deadline. Recently, some of the nation’s largest banks revealed their plans, each with a varying degree of commitment to the directive. More than 3 million households are behind on their mortgage payments and nearly 1.7 million will exit their forbearance period in September, Fox News reports. The federal government wants to mobilize additional ARP funds to create more permanent affordable housing on a state level, the Biden administration said, and support local initiatives to curtail homelessness.

No comments:

Post a Comment